Life Insurance in and around Columbia

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

State Farm understands your desire to care for the ones you hold dear after you pass. That's why we offer fantastic Life insurance coverage options and dependable compassionate service to help you settle upon a policy that fits your needs.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

When picking how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like your age, your physical health, and perhaps even family medical history and body weight. With State Farm agent Ashley Johnson, you can be sure to get personalized service depending on your individual situation and needs.

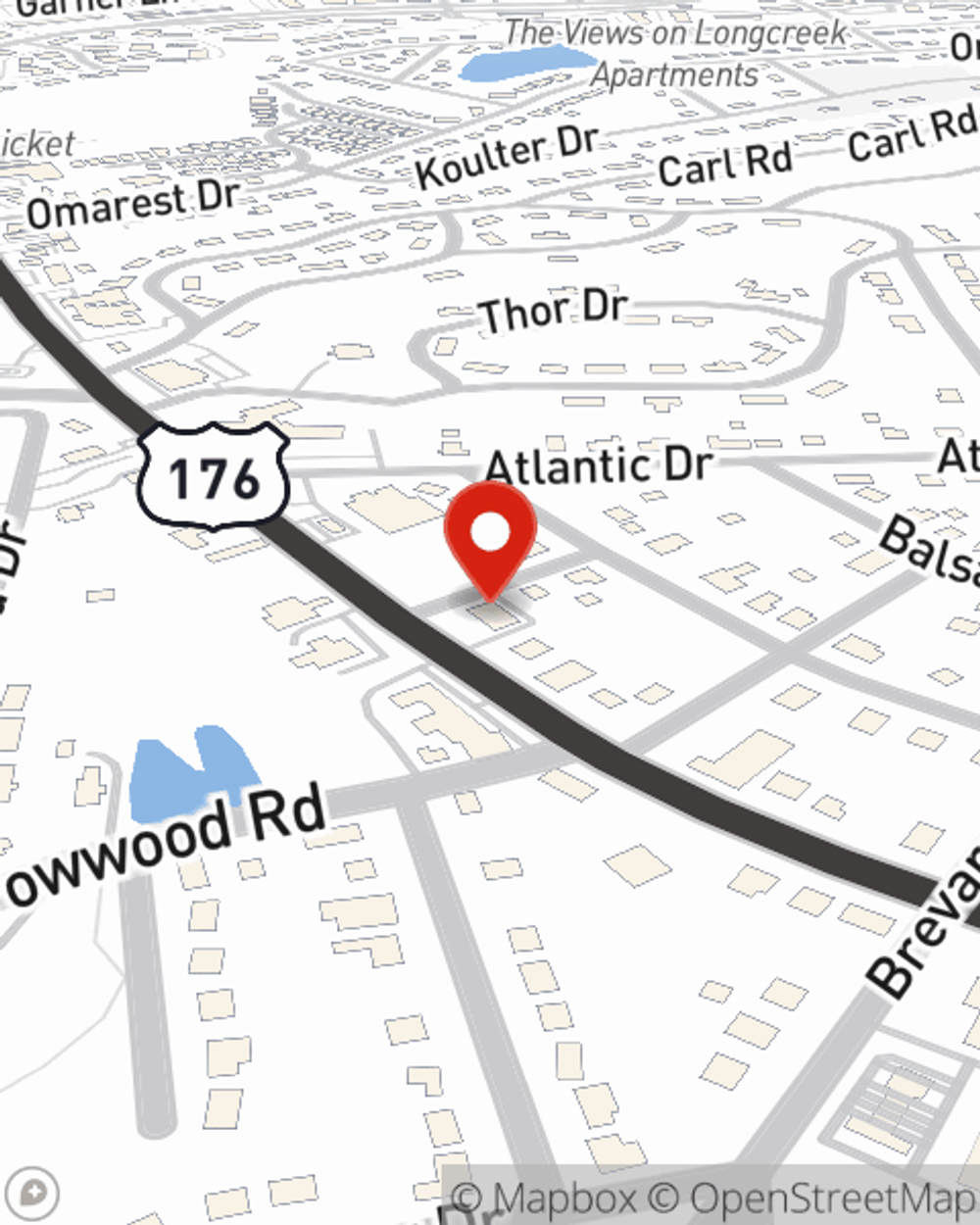

It's never a bad time to make sure your loved ones have coverage against the unexpected. Visit Ashley Johnson's office to learn more about your Life insurance options with State Farm.

Have More Questions About Life Insurance?

Call Ashley at (803) 772-0137 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Ashley Johnson

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.